Guard Your Financial Future – Easy Ways To Monitor Your Credit Score

Executive Contributors at Brainz Magazine are handpicked and invited to contribute because of their knowledge and valuable insight within their area of expertise.

Section 1: Understanding your credit score

Explanation of what a credit score is and why it matters.

Breakdown of the factors that influence credit scores: payment history, credit utilization, length of credit history, types of credit, and new credit inquiries.

Section 2: Starting with the basics

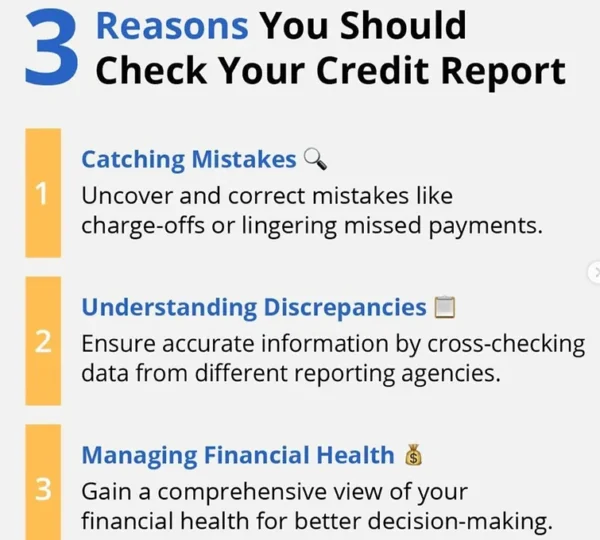

How to obtain your credit report from the three major credit bureaus (Equifax, Experian, and TransUnion).

Discussion on the legality of one free credit report per year under the Fair Credit Reporting Act. Also, debunking the myth that checking your credit reports frequently will hurt your credit.

Tips for reading and understanding your credit report.

Section 3: Monitoring your credit score regularly

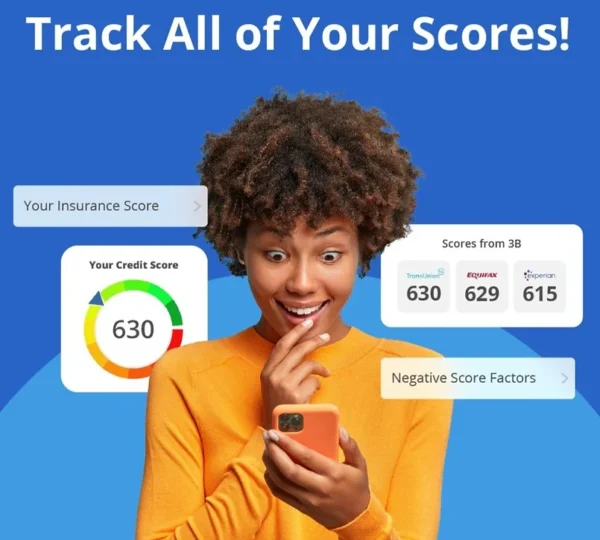

Tools and methods for monitoring your credit score.

Free vs. paid credit monitoring services.

Mobile apps and websites that offer credit score updates. Setting up alerts for credit score changes.

Section 4: Identifying and addressing errors

How to spot errors on your credit report.

Steps to dispute inaccuracies with credit bureaus.

Importance of checking your credit report regularly to catch identity theft early.

Best practices for improving your credit score: timely payments, reducing debt, not opening too many new accounts at once.

Section 6: Advanced monitoring techniques

Explanation of different credit scoring models (FICO vs. Vantage Score). How to interpret different scores from different bureaus.

Recap of the importance of regularly monitoring and understanding your credit score.

Additional resources:

Visit our website, Credit Monitoring Tool, and Social Media, for further assistance and information.

Understanding your credit score what’s in a number?

Your credit score is more than just a number; it's a snapshot of your financial health. It's determined by factors like how timely you pay your bills, how much debt you've got, and how long you've been managing credit. Banks, lenders, employers, and sometimes landlords peek at this score to decide if they want to do business with you. They want to identify whether you are a liability or an asset to them. The credit score breakdown here’s a quick run-down Payment History: This is like the attendance record on your adult report card. Paying bills on time? Gold star for you! Credit Utilization: How much of your available credit you're using. Maxing out your cards? Not so great. Length of Credit History: How long you’ve had credit. Longer histories can be better, showing you’re a seasoned credit user. The objective is to establish a positive history on your credit report. Types of Credit: A mix of credit types (like loans and credit cards) can be beneficial. New Credit Inquiries: Applying for a bunch of new credit cards? It might look like you’re in financial trouble. Rule of Thumb: We never want to seem desperate to the banks!

Starting with the basics

Monitoring your credit score regularly tools of the trade

You’ve got options here. Tons of free services offer credit score updates, like Credit Karma or Mint. However, we would like to drop a truth bomb... Ever heard the saying "You get what you paid for?" Well in this case you're not paying to monitor your credit through apps like Credit Karma or Mint. We are about providing value to our viewers but most importantly our objective is to be ethical. Are you still following us? Okay, great! Here's the truth bomb: Platforms like Credit Karma and Mint are not credit reporting agencies they are marketing agencies that get paid to market other companies’ products and services. Yes, you heard that right! They do not report accurate information on consumers’ credit reports.

Set up alerts so you’re notified of any changes to your score. It’s a simple way to keep tabs without having to constantly check.

Identifying and addressing errors detective work

Errors on credit reports are more common than you’d think. Incorrect late

Cleaning up

Found a mistake? File a dispute with the credit bureau. They’re legally required to investigate. Remember, accuracy is key to a healthy credit score.

Improving and maintaining a good credit score the long game

Improving your credit score isn’t a sprint; it’s a marathon. Keep your credit utilization low, pay your bills on time, and don’t go crazy opening new accounts.

Consistency is key

Just like a diet, the best results come from consistent, healthy habits. Keep an eye on your spending, and stick to a budget.

Advanced monitoring techniques not all scores are created equal

Did you know there are different credit scoring models? FICO and VantageScore are the big ones, and they can sometimes show different scores.

Knowledge is power

Some tools let you simulate how certain actions, like paying off a loan or increasing your credit limit, could affect your score. It’s like having a financial crystal ball! We created a built-in simulator tool which is called ScoreBoost - This educates our clients on how to properly leverage their credit card debt and has drastically increased our client's credit scores in less than 30 days! Game Changer!

Navigating financial challenges bumps in the road

Life happens. If you hit a rough patch, don’t panic. Options like credit counseling or debt consolidation can help get you back on track.

A success story

Take the case of Brown Assets Group a successful credit repair company. They’ve helped countless individuals navigate through tough financial waters and come out with improved credit scores. Their key advice? Stay proactive and don’t be afraid to seek help when needed.

Check out this article from CNBC and the advantages of having a good credit score.

Conclusion

Monitoring your credit score might seem like a chore, but it’s crucial for your financial well-being. Remember, it's about taking those small, consistent steps toward a healthier financial future. You've got this!

Additional resources

For those who want to dive deeper and take action on protecting your credit scores, check out our websites Visit our website or Create Your Credit Monitoring Account Here and consider reading books on personal finance and the Power of Credit Grab a Copy of My E-book. Follow Us On Instagram.